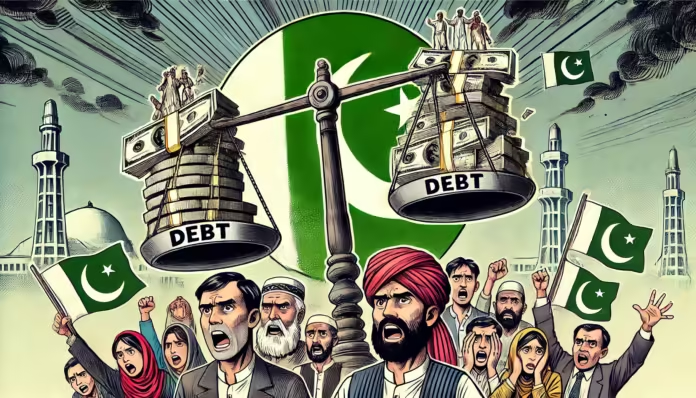

As of fiscal year 2024, the average debt crisis on each Pakistani has surged to Rs. 302,000, marking an 11.3% increase compared to FY2023. This alarming rise reflects the mounting obligations to both national and international lenders, exacerbating the country’s economic challenges.

Statistics at the moment

According to recent data, Pakistan’s total debt and liabilities crossed Rs. 68 trillion by the end of FY2024, Debt Crisis increase driven by heavy borrowing to meet budgetary deficits, service existing debts, and stabilize the economy. In comparison, the debt per capita stood at Rs. 271,000 in FY2023, illustrating the escalating financial pressures on the nation.

Several factors contribute to this rising debt burden:

- Currency Depreciation: The weakening Pakistani rupee has inflated the cost of servicing external loans, further straining public finances.

- High Interest Rates: Elevated interest rates have made domestic borrowing more expensive, adding to the fiscal deficit.

- Energy and Import Bills: Rising energy import costs and subsidies have compelled the government to rely on external financing to bridge gaps.

- Revenue Shortfalls: Despite efforts to increase tax collection, the revenue remains insufficient to meet burgeoning expenses.

Implications for the Economy

The growing debt has far-reaching consequences for the economy and citizens:

- Limited Development Spending: A significant portion of the national budget is diverted toward debt servicing, leaving little room for developmental projects.

- Inflationary Pressures: Borrowing often leads to increased money supply, contributing to inflation that affects everyday citizens.

- Investor Confidence: High debt levels deter foreign investment, slowing economic growth and innovation.

Government’s Response

In response to this debt crisis, the government has initiated several measures, including:

- Negotiating extended payment terms with international lenders and seeking debt relief where possible.

- Introducing reforms to broaden the tax base and increase revenue collection.

- Encouraging public-private partnerships to reduce reliance on state funds.

The Way Forward

While short-term measures may provide temporary relief, long-term structural reforms are critical to reducing the debt burden. These include enhancing export capacity, promoting energy efficiency, and fostering an environment conducive to investment and industrial growth.

Pakistan’s rising debt highlights the urgent need for fiscal discipline and sustainable economic policies. Without decisive action, the growing financial strain risks undermining the nation’s economic stability and development potential.

Each Pakistani’s share of the national debt serves as a reminder of the collective responsibility to address these challenges. Policymakers and citizens alike must prioritize sustainable growth and prudent financial management to secure a brighter future for the country.

For official debt and liability statistics visit SBP Website